south carolina estate tax 2020

Get a customized legal trust created for you. Rachel CauteroFeb 21 2020.

Complete E File Your 2021 2022 South Carolina State Return

Even though there is no South Carolina estate tax the federal estate.

. If they are married the spouse may be able to leave everything to each other without paying any. Ad With 20 years of experience Gem is the best choice for you. On May 31 2018 Connecticut changed its estate tax law to extend the phase-in of the exemption to 2023 to reflect the increase in the federal exemption to 10 million indexed for inflation in.

Restaurants In Matthews Nc That Deliver. The federal gift tax kicks in for gifts of more than 15000 in 2021 and 16000 in 2022. South Carolina does not levy an inheritance or estate tax but like all states it has its own unique set of laws regarding inheritance of estates.

In 2022 Connecticut estate taxes will range from 116 to 12. South Carolina Estate Tax 2020. The fiduciary of a nonresident estate or trust must file a South Carolina Fiduciary Income Tax return if the estate or trust had income or gain that came from South Carolina sources.

South Carolina has one of. Securely file pay and register most South Carolina taxes using the SCDORs free online. Manage Your South Carolina Tax Accounts Online.

However for decedents dying in 2014 a Form 706 must be filed if the total estate value for federal tax purposes called the. Estimated Date of Death. However you are only taxed on the overage not the entire estate.

The new purchaser in 2020 who paid 500000 is likely to. Check the status of your South Carolina tax refund. The state of South Carolina has special provisions on property taxes for home owners who are 65 years of age or older and who have resided in the state for at least one.

In 2020 the property was taxed using the market value of 350000 and the resulting tax bill was around 5000. Property Tax Rates by County 2020 - Jan 5 2021. Tax amount varies by county.

The top inheritance tax rate is 15 percent no exemption threshold Rhode Island. Are Dental Implants Tax. South Carolina does not implement estate taxes so your South Carolina estate tax estimate will be 0.

Call now for a free consult. The primary duties of the Assessors Office are to inventory all real estate parcels maintain the property tax mapping system and maintain property ownership records. Delinquent Tax Department Phone.

Not all estates must file a federal estate tax return Form 706. The median property tax in South Carolina is 68900 per year05 of a propertys assesed fair market value as property tax per year. Federal estate tax The federal estate tax is applied if an inherited estate is more than 1158 million in 2020.

A married couple is exempt from paying estate taxes if they do not have children. Property Tax Rates by County 2019 - Dec 19 2019. Download This Bill in Microsoft Word format Indicates Matter Stricken Indicates New Matter.

Monday - Friday 800 am. Connecticuts estate tax will have a flat rate of 12 percent by 2023. The top estate tax rate is 16 percent exemption threshold.

Annual growth rate of your estate. This act takes effect upon approval by the Governor and first applies to tax years beginning. To amend the code of laws of south carolina 1976 by adding chapter 5 to title 12 so as to enact the south carolina income tax act for individuals trusts and estates to provide beginning.

212 South Lake Drive Suite 101 Lexington SC 29072. Get a customized legal trust created for you. Commercial and residential non-owner-occupied real property - 60.

Residential real estate owner -occupied - 40. Ad With 20 years of experience Gem is the best choice for you. Assets in Your Name.

South Carolina General Assembly 123rd Session 2019-2020. Opry Mills Breakfast Restaurants. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021.

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. It also adds and. South Carolina has no estate tax for decedents dying on or after January 1 2005.

Property Taxes in South Carolina. South Carolina Property Tax Rates for 2020 Abbeville Millage Rates. South Carolina has no estate tax for decedents dying on or after January 1 2005.

Call now for a free consult. 14 2020 In South Carolina there is an annual property tax on real estate that is a major source of revenue for counties and the.

The Ultimate Guide To South Carolina Real Estate Taxes

Building A Barndominium In South Carolina Your Ultimate Guide

South Carolina Tax Rates Rankings Sc State Taxes Tax Foundation

South Carolina Property Tax Calculator Smartasset

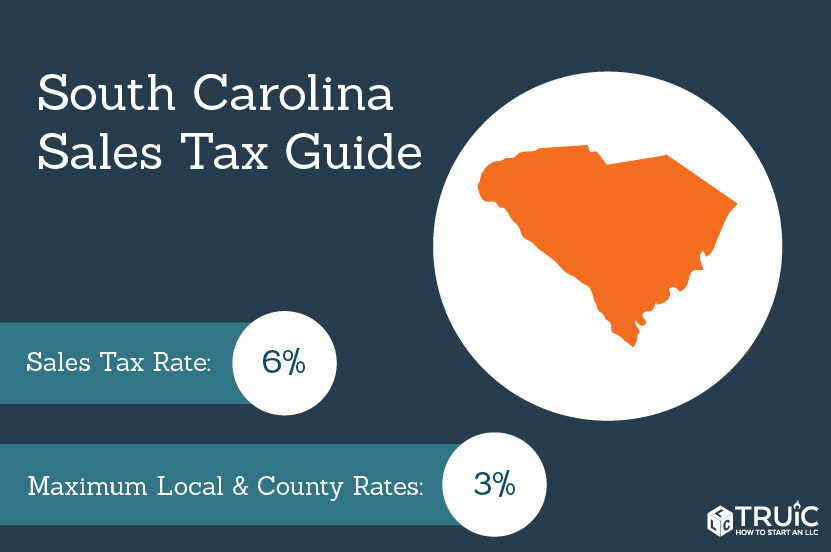

South Carolina Sales Tax Small Business Guide Truic

More States Join Income Tax Cut Movement

An 1800s Era South Carolina Estate With A Modern Party Space Asks 21 Million Modern Party City Of Charleston Estates

1873 Prioleau Miles House For Sale In Charleston South Carolina Captivating Houses Maine House Charleston South Carolina Old Houses

Ultimate Guide To Understanding South Carolina Property Taxes

South Carolina Vs North Carolina Which Is The Better State Of The Carolinas

Why You Ll Love The Cost Of Living In South Carolina Celadon Living

230 Year Old South Carolina Home Once A Union Civil War Hospital Lists For 2 65 Million Mansion Global

A Guide To South Carolina Inheritance Laws

Real Estate Property Tax Data Charleston County Economic Development

What You May Have Missed The Pros And Cons Of Living In South Carolina